CRE Differences

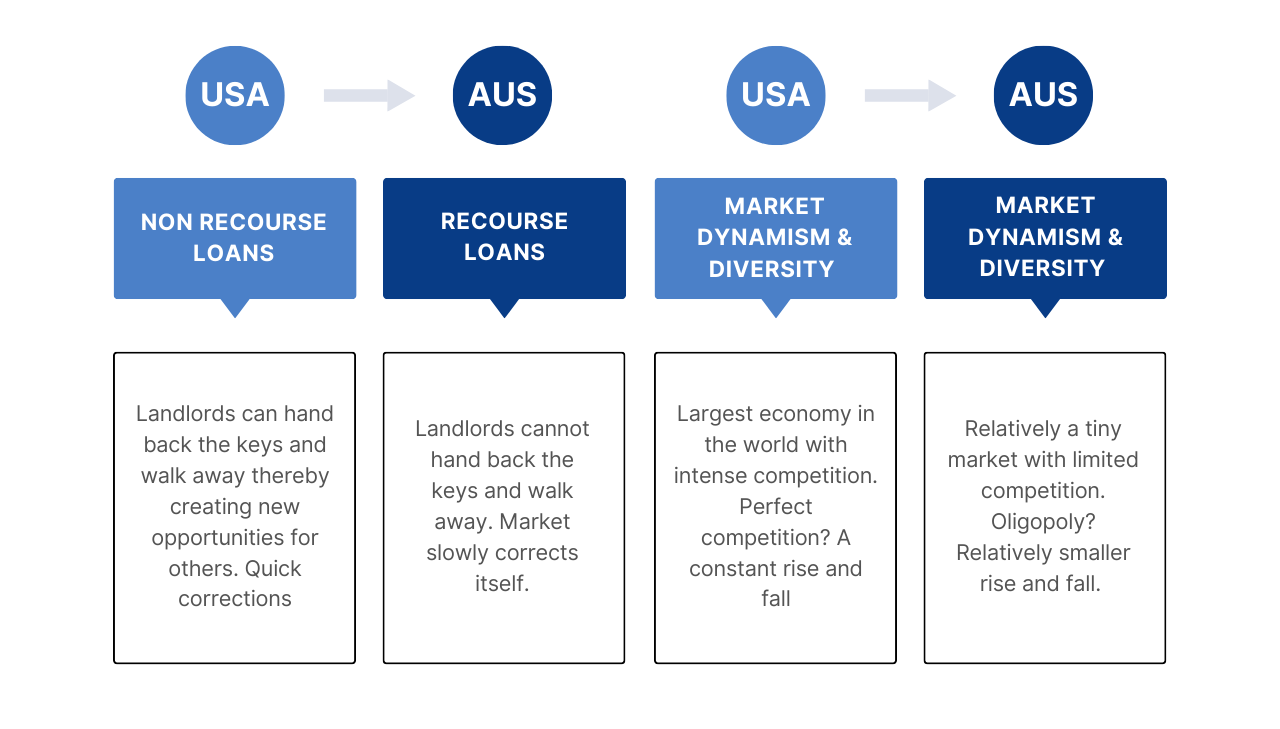

Just because we read articles where office buildings in the US get sold for cents on the dollar, doesn’t mean our market should do the same. If it did, there would be buying opportunities everywhere and we would be converting many more office buildings to solve our residential dwelling shortage (see last week’s repurposing CREview). It would create a more dynamic and diverse market, but our market does not work the same as the US CRE market.

At the TCN Conference in Calgary, we presented a snapshot of the Australian CRE markets. The only way to start was to put the markets into perspective and the best example is that the entire Australian office and industrial markets fit into Chicago. Size is an obvious difference. There are many others of which a few are highlighted below. Of course, there are exceptions to every generalisation.

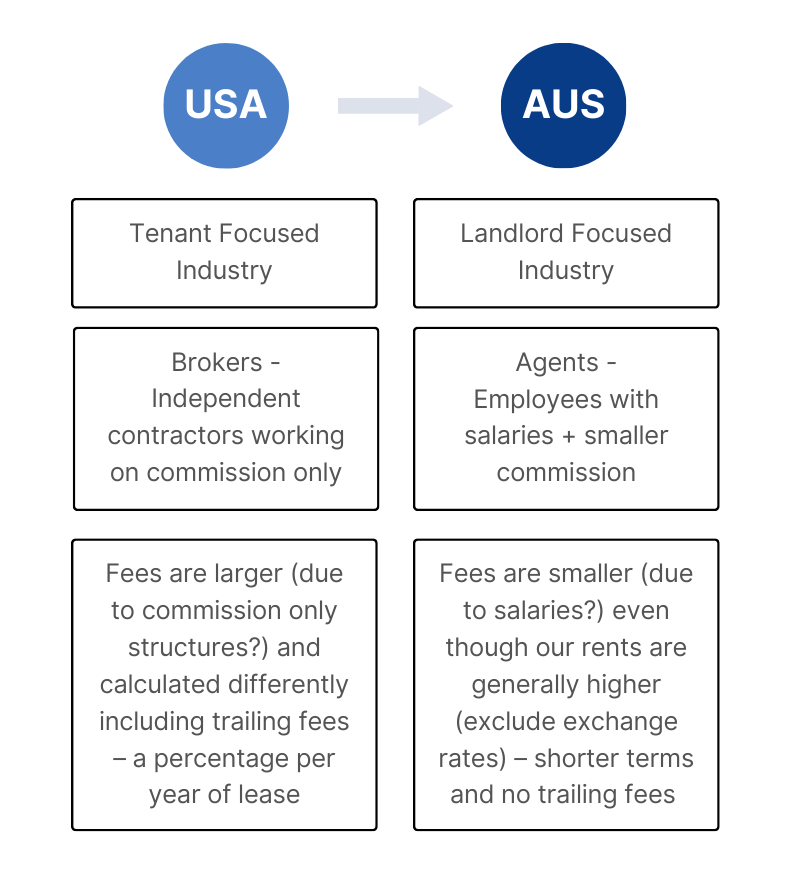

In the CRE agency world there are differences as well:

There are many more differences which is why the markets and market participants behave so differently. For an audience from Canada and the US it is hard to understand. For us it is the way our market works. Practices over there are not the same as here and vice versa.

Can’t wait for next year’s conference in Nashville.

No Comments